Table of Content

Single filers can keep $250,000, with the same limit applied to married couples who decide to file separately. However, one piece of good news is that the deduction is still active if you use the money to buy, build, or improve a home/second home. If you have a mortgage, you can fully deduct the value of the points from your tax. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This compensation may impact how and where listings appear.

Married couples filing separately will see the deduction removed if they earn more than $55,000 per year. Taxpayers who own more than one home can only exclude the gain on the sale of their main home. They must pay taxes on the gain from selling any other home. Lenders charge private mortgage insurance to borrowers who put down less than 20% on a conventional loan. In situations like this, the exclusions of gain could potentially not be given completely, instead prorated.

Current Indianapolis Mortgage Rates

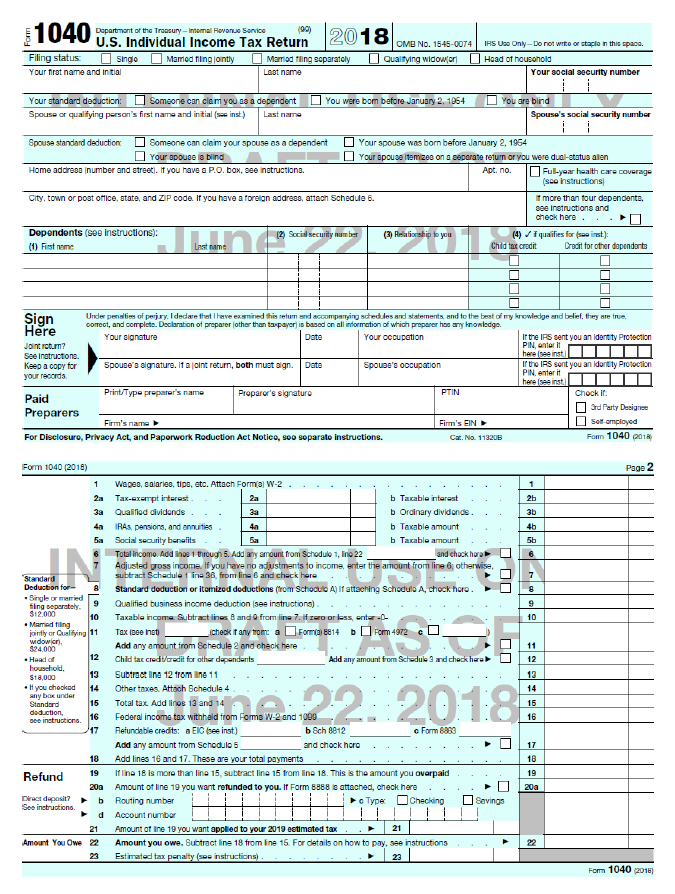

The last common mistake that homebuyers make is failing to file the correct paperwork. This can result in delays or even denial of your deduction. To avoid these mistakes, be sure to itemize your deductions, keep track of your expenses, and file the correct paperwork. Doing so will help you maximize your deduction and save you money come tax season. If you don't itemize your deductions, you won't be able to take advantage of the interest deduction on your new mortgage.

In fact, the IRS itself features some of the deductions that you can take right on its own website. The above rates are separate from Federal Insurance Contributions Act taxes which fund Social Security and Medicare. Employees and employers typically pay half of the 12.4% Social Security & 1.45% Medicare benefit each, for a total of 15.3%.

Home office deduction

These assessments are discussed earlier under State and Local Real Estate Taxes. 551 gives more information, including examples, on figuring your basis when you receive property as a gift. If you use the donor's adjusted basis to figure a gain and it results in a loss, then you must use the FMV to refigure the loss. However, if using the FMV results in a gain, then you have neither a gain nor a loss. If someone gave you your home and the donor's adjusted basis, when it was given to you, was more than the FMV, your basis at the time of receipt is the same as the donor's adjusted basis.

This is one of the most common mistakes that homebuyers make when deducting their new home purchase on their taxes. Certain energy-efficient home improvements can also be deducted from your taxes. The Energy Star program offers a tax credit for certain energy-efficient home improvements, such as windows, doors, and insulation.

How to Buy a House While Selling Your Own: 10 Options to Consider

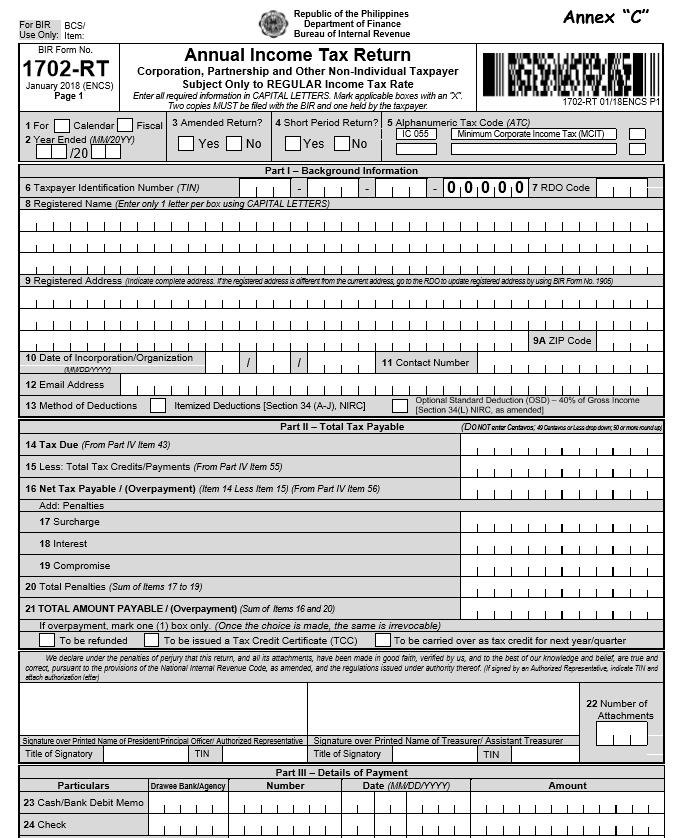

See the Instructions for Form 5695, Residential Energy Credits, for more information. Similar to a transfer tax, some states also charge mortgage registration or deed taxes. These taxes are traditionally paid by buyers, because they're the ones getting mortgages. In Minnesota, the mortgage registration tax is 0.23 percent, Florida's is 0.35 percent and Oklahoma's varies from 0.02 to 0.1 percent. When you use an ATM, in addition to the fee charged by the bank, you may be charged an additional fee by the ATM operator. See your Cardholder Agreement for details on all ATM fees.

Go to IRS.gov/Forms to view, download, or print all of the forms, instructions, and publications you may need. Or, you can go to IRS.gov/OrderForms to place an order. The following IRS YouTube channels provide short, informative videos on various tax-related topics in English, Spanish, and ASL. Required to include their preparer tax identification number . On IRS.gov, you can get up-to-date information on current events and changes in tax law.. ▶ Automatic calculation of taxable social security benefits.

Mortgage Credit Certificate

Another major benefit of owning a home is that the tax law allows you to shelter a large amount of profit from tax if certain conditions are met. If you are single and you owned and lived in the house for at least two of the five years before the sale, then up to $250,000 of profit is tax-free. Real estate transfer taxes can come due in some states when a house is sold, but home sellers, not homebuyers, are typically responsible for paying this tax.

While you can't deduct the entire purchase price of your home on your taxes, there are certain situations in which a portion of the purchase can be deducted. To start, let's cover the basics of how deductions work. A deduction is an expense that can be subtracted from your taxable income.

Your lender will usually mail you and the Internal Revenue Service a copy of Form 1098 in January. You can contact the company to request one if you don't receive it. Taxpayers who don’t qualify to exclude all of the taxable gain from their income must report the gain from the sale of their home when they file their tax return.

Lenders will include interest for the partial first month of your mortgage as part of your closing. Ask your lender or mortgage broker to point this out to you. If it’s not included on your 1098, add this to your total mortgage interest when doing your taxes. When a consumer takes out a mortgage, they are often charged costs by the lender called origination points. Most often, discount points can be deducted as long as it is within the year that you bought the home and your deductions are itemized.

If you are a minister or a member of the uniformed services and receive a housing allowance that isn’t taxable, you can still deduct your real estate taxes and your home mortgage interest. You don’t have to reduce your deductions by your nontaxable allowance. 517, Social Security and Other Information for Members of the Clergy and Religious Workers, and Pub. For 2022, the standard deduction is $12,950 for single and married filing separately taxpayers, $19,400 for heads of household, and $25,900 for married filing jointly filers and surviving spouses. For 2021, the standard deduction is $12,550 for single and married filing separately taxpayers, $18,800 for heads of household, and $25,100 for married filing jointly filers and surviving spouses.

Interest payments from banks are recorded on 1099-INT forms. But as you start to settle into your new home, reality starts to set in. You're responsible for upkeep, repairs, and most importantly – the rising costs of mortgage payments. IN homebuyers and refinancers can use the filters at the top of the table to see the monthly payments and rates availble for their loans. The basis includes the price you originally paid for the house, which is a good thing! But you can also add on a variety of expenses related to buying and making improvements to your house.

You can't include in basis the value of your own labor or any other labor for which you didn't pay. Additional debt incurred to substantially improve your principal residence is also qualified principal residence indebtedness. The mortgage interest statement you receive should show not only the total interest paid during the year, but also your deductible points paid during the year. You figure your share of real estate taxes in the following way.

If you pay any part of the seller's share of the real estate taxes , and the seller didn't reimburse you, add those taxes to your basis in the home. The points weren't paid in place of amounts that ordinarily are stated separately on the settlement statement, such as appraisal fees, inspection fees, title fees, attorney fees, and property taxes. For qualifying debt taken out on or before December 15, 2017, you can only deduct home mortgage interest on up to $1 million ($500,000 if you are married filing separately) of that debt. The only exception is for loans taken out on or before October 13, 1987; see Pub. 936 for more information about loans taken out on or before October 13, 1987. Real estate taxes are generally divided so that you and the seller each pay taxes for the part of the property tax year you owned the home.

No comments:

Post a Comment